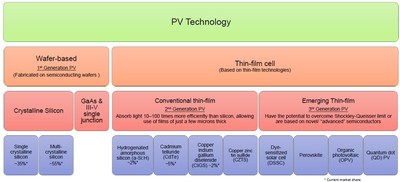

There are several flavors of technology today jostling to make the dream of electricity-generating windows a reality. While these are likely too expensive and inefficient to be in your home any time soon, pilot projects for such windows in commercial buildings are gaining momentum, and studies (utilizing annual data of sunlit areas in cities) have claimed potential gigawatt-hours of electricity generation in the windows on a high-rise. The graphic below from the IDTechEx Research report “Smart Glass and Windows 2018-2028: Electronic Shading and Semi-Transparent PV” gives an overview of some of the conventional and emerging photovoltaic (PV) technologies.

Source: IDTechEx Research (PRNewsfoto/IDTechEx)

Today, the flavor of this technology with the largest established base of installations is of crystalline silicon (c-Si) manufactured into strings and laminated in glass, which has been sold since 2009. One reason for this is that c-Si is some decades old and is proven to last in performance and aesthetics for north of 25 years: this reassures building owners and designers. The weakness is the non-uniform transparency (lines created by the c-Si strings giving a ‘grating’ effect), and a ceiling of 60 percent visible transparency. Ultimately this results in a disadvantage that so far has prevented the market from truly taking off. However, there is a strengthening case for use of this glass horizontally placed, like in a skylight, or integrated into the building envelope as a facade. In other words, glass areas that are not meant to be looked through. By our estimates at IDTechEx, the volume of this market is to the order of hundreds of thousands of square meters a year and growing.

An emerging thin-film PV with promise is organic photovoltaics (OPV). The main advantages of OPV are a potential for over 80 percent visible transparency (which is comparable to conventional glazing), a flexibility, which means a curved glass is possible (for, say, an electric vehicle, where there is also a trend for an increasing glass area per car), and it is lightweight. An added benefit is that the high transparency is achieved by being more reliant on other parts of the electromagnetic spectrum – UV and infra-red – which provides the advantage of blocking heat entering a building, allowing you to turn down the power setting of your air-conditioning and save electricity.

OPV is just beginning to be commercialized, and a handful of companies in the space are making progress. One company called Sunew have already installed OPV in a skylight in São Paulo. While this is a major step, it is not highly transparent and at a distance looks similar to what conventional PV looks like stuck on a flat surface. Other companies interviewed by IDTechEx have attracted partnerships with members of the big four glaziers (AGC, Nippon Sheet Glass, Guardian, Saint Gobain), and have plans for market entry as early as next year.

The Achilles heel of OPV is the low efficiency (which is below 5 percent, often below 3 percent), and the lifetime and stability. OPV companies typically quote lifetimes that range between five and ten years, depending on the application. Our understanding at IDTechEx is that ten years would be for a static application such as a commercial building or high-rise, and a car, which is subject to more shocks, would sit at the five-year end of this spectrum (or worse). Anything below 25 years of life is a tough sell for the construction industry, which means advancements are likely required before mainstream adoption in this segment.

IDTechEx has recently published a major update to its market report on Smart Glass, which covers electricity-generating glass based on organic photovoltaics (OPV), solar concentrators and more. Check “Smart Glass and Windows 2018-2028: Electronic Shading and Semi-Transparent PV”at http://www.IDTechEx.com/glass to learn more.