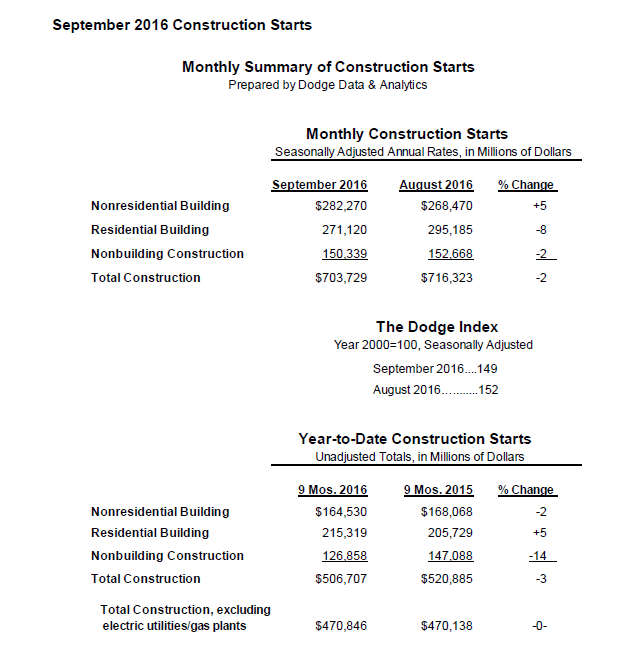

The value of new construction starts in September decreased a slight 2% to a seasonally adjusted annual rate of $703.7 billion, according to Dodge Data & Analytics. This follows the 22% jump for total construction starts in August, which witnessed the highest monthly pace for construction starts so far in 2016.

Nonresidential building showed further strength in September, exceeding its elevated August amount. The lift for nonresidential building in September came from the start of two very large office towers in New York NY with a combined construction start cost of $3.5 billion, as well as eight large hospital projects that together summed to $2.2 billion. However, the housing sector lost momentum in September, pulling back from August which included groundbreaking for a number of very large multifamily projects. Nonbuilding construction also slipped in September, following its improved August volume that included the start of a $3.0 billion pipeline upgrade in the southeastern part of the nation. Through the first nine months of 2016, total construction starts on an unadjusted basis were $506.7 billion, trailing the same period a year ago by 3%.

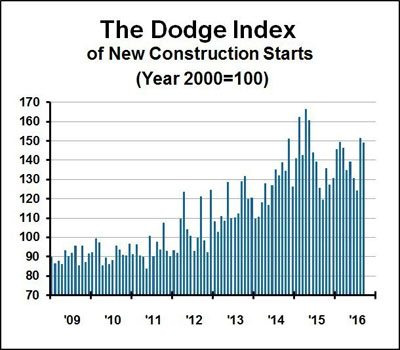

The September data produced a reading of 149 for the Dodge Index (2000=100), down from an upwardly revised 152 for August. September was still fairly high by recent standards, coming in 6% above the average of the previous eight months.

The September data produced a reading of 149 for the Dodge Index (2000=100), down from an upwardly revised 152 for August. September was still fairly high by recent standards, coming in 6% above the average of the previous eight months.

“Whether looking at construction starts month-to-month or quarter-to-quarter, the past two years have shown considerable volatility, reflecting in part when very large projects were entered as construction starts,” stated Robert A. Murray, chief economist for Dodge Data & Analytics. “The first two quarters of 2015 included 13 very large projects valued each at $1 billion or more, followed by only one such project in last year’s third quarter. The current year has assumed a ‘mirror image’ quality with respect to the timing of very large projects – only four were entered as construction starts during this year’s first two quarters, but in the just completed third quarter six such projects were entered as construction starts. When combined with the more broad-based strengthening for construction that’s taken place in this year’s August and September, and with the comparison to the subdued activity for the same two months a year ago, the year-to-date shortfall for total construction starts has become considerably smaller than what was reported earlier in the year.”

“While the year-to-date percent change for total construction starts at the 7-month mark was initially reported as down 11%, at the 8-month mark it was down 7% and at the 9-month mark it was down just 3%,” Murray continued. “Furthermore, if the volatile electric utility/gas plant category is removed from the year-to-date comparison, total construction starts would be flat with last year. Increasingly, it appears that 2016 is shaping up as a year when the overall level of construction starts is essentially holding steady. This is being supported by such economic factors as moderate job growth, generally healthy market fundamentals for commercial real estate, and the funding coming from state and local bond measures that have been passed in recent years.”

Nonresidential building

Nonresidential building in September increased 5% to $282.3 billion (annual rate), following the 43% surge in August which benefitted from the start of a $3.0 billion petrochemical plant in Louisiana and the $1.7 billion Wynn Casino in Everett MA.

Nonresidential building in September increased 5% to $282.3 billion (annual rate), following the 43% surge in August which benefitted from the start of a $3.0 billion petrochemical plant in Louisiana and the $1.7 billion Wynn Casino in Everett MA.

The nonresidential increase in September was led by a 148% jump for office construction, which reflected the start of two massive office towers in New York City – the $2.0 billion, 66-story 3 Hudson Yards Boulevard office building on Manhattan’s west side and the $1.5 billion, 67-story One Vanderbilt Tower near Grand Central Station. September also featured the start of seven additional office buildings each with a construction start cost of $100 million or more, including the $280 million design center at the Ford Motor Company’s Dearborn MI office campus, the $209 million Four Constitution Square office complex in Washington DC, and the $178 million Oracle Corporation office campus in Austin TX. Store construction also strengthened in September, rising 31% and helped by the start of a $150 million mall expansion in Staten Island NY.

On the negative side, hotel construction in September retreated 30% after its substantial August gain, although September did see groundbreaking for the $123 million Ritz Carlton Hotel in Paradise Valley AZ. Commercial garages and warehouses experienced respective declines of 20% and 17% in September.

As a group, the commercial categories in September registered a 37% increase, after the 31% gain reported in August. The improved levels for commercial building in August and September followed a lackluster amount of construction starts during the previous four months. The manufacturing plant category in September dropped 84%, after being boosted in August by the $3.0 billion petrochemical plant in Louisiana.

The institutional side of the nonresidential building market advanced 8% in September. Much of the lift came from a strong volume for healthcare facilities which climbed 57%. There were eight healthcare facilities valued each at $100 million or more that reached groundbreaking in September, with the two largest being a $756 million healthcare facility complex in Loma Linda CA and the $500 million Vassar Brothers Medical Center patient pavilion in Poughkeepsie NY.

New education facility projects grew 4% in September, helped by three large college/university science buildings – a $175 million science center at Amherst College in Amherst MA, a $120 million engineering and sciences facility at Texas State University in San Marcos TX, and a $115 million biomedical sciences and engineering facility at the University of Maryland in Rockville MD.

For the smaller institutional categories, gains were reported in September for public buildings, up 10%; and religious buildings, up 40% from weak activity in August. Amusement construction starts were down 32% from August which included $975 million for the casino portion of the Wynn Casino, although September did see groundbreaking for the $486 million Milwaukee Bucks basketball arena in Milwaukee WI. Transportation terminal work in September was down 8%, although the latest month did include the $442 million Terminal 1 Center renovation at San Francisco International Airport.

Residential building

Residential building, at $271.1 billion (annual rate), fell 8% in September. Multifamily housing retreated after a strong performance in August, falling 17%. While August included 13 multifamily projects valued each at $100 million or more, there were only five such projects that reached groundbreaking in September, including a $225 million multifamily building in Seattle WA and a $145 million multifamily building in Milwaukee WI.

Residential building, at $271.1 billion (annual rate), fell 8% in September. Multifamily housing retreated after a strong performance in August, falling 17%. While August included 13 multifamily projects valued each at $100 million or more, there were only five such projects that reached groundbreaking in September, including a $225 million multifamily building in Seattle WA and a $145 million multifamily building in Milwaukee WI.

Through the first nine months of 2016, the top five metropolitan areas ranked by the dollar amount of multifamily starts were New York NY, Los Angeles CA, Chicago IL, Miami FL, and Boston MA. Metropolitan areas ranked 6 through 10 were Washington DC, San Francisco CA, Dallas-Ft. Worth TX, Atlanta GA, and Denver CO. While the New York NY metropolitan area continues to be the leading market for multifamily construction by dollar volume, its year-to-date amount for 2016 is down 27%, and its share of the national total has fallen from 26% for all of 2015 to 19% so far in 2016.

Single family housing in September dropped 4%, slipping back slightly from the plateau that’s been present for much of 2016. By geography, single family housing in September showed weaker activity in the South Atlantic, down 9%; the South Central and West, each down 2%; the Midwest, down 1%; while the Northeast was unchanged from August.

Nonbuilding construction

Nonbuilding construction in September dropped 2% to $150.3 billion (annual rate). Pulling the nonbuilding total down was a 72% plunge for the “miscellaneous public works” category, which includes such diverse project types as pipelines, mass transit, and site work. The August amount for this category had been boosted by the start of the $3.0 billion Sabal Trail and Florida Southeast Connection natural gas pipeline upgrade project, which will transport natural gas from Alabama through Georgia and into central Florida. By contrast, the largest miscellaneous public works project reported as a September start was a $244 million landfill project in Staten Island NY.

Nonbuilding construction in September dropped 2% to $150.3 billion (annual rate). Pulling the nonbuilding total down was a 72% plunge for the “miscellaneous public works” category, which includes such diverse project types as pipelines, mass transit, and site work. The August amount for this category had been boosted by the start of the $3.0 billion Sabal Trail and Florida Southeast Connection natural gas pipeline upgrade project, which will transport natural gas from Alabama through Georgia and into central Florida. By contrast, the largest miscellaneous public works project reported as a September start was a $244 million landfill project in Staten Island NY.

The environmental public works categories in September were mixed, with weaker activity for sewers, down 23%; but growth for river/harbor development, up 16%; and water supply systems, up 20%.

Highway and bridge construction in September climbed 17%, aided by the start of a $916 million segment of the Loop 202 (South Mountain Freeway) project in the Phoenix AZ area. Also starting in September was the $221 million Port Access Road in the Charleston SC area.

New electric utility starts jumped 219% in September from a subdued August. Large electric utility projects that contributed to September’s increase were a $1.3 billion natural gas-fired power plant in Virginia, a $600 million power plant coal burner replacement in Minnesota, and a $417 million wind farm in Illinois.

The 3% decline for total construction starts on an unadjusted basis during the first nine months of 2016 was due to a mixed pattern by major sector.

- Nonresidential building year-to-date was down a slight 2%, with commercial building up 10%, institutional building even with last year, and manufacturing plants down 45%.

- Residential building year-to-date advanced 5%, with single family housing up 7% while multifamily housing was unchanged.

- Nonbuilding construction year-to-date fell 14%, with public works down 6% and electric utilities/gas plants down 29%.

By geography, total construction starts during the January-September period of 2016 revealed these changes compared to the same period a year ago – the Midwest, up 9%; the South Atlantic, up 7%; the West, up 5%; the Northeast, down 5%; and the South Central, down 22% (reflecting this region’s comparison to last year which included several massive liquefied natural gas export terminals).

About Dodge Data & Analytics

Dodge Data & Analytics is a technology-driven construction project data, analytics and insights provider. Dodge provides trusted market intelligence that helps construction professionals grow their business, and is redefining and recreating the business tools and processes on which the industry relies. Dodge is creating an integrated platform that unifies and simplifies the design, bid and build process, bringing data on people, projects and products into a single hub for the entire industry, from building product manufacturers to contractors and specialty trades to architects and engineers. The company’s products include Dodge Global Network, Dodge PlanRoom, Dodge PipeLine, Dodge SpecShare, Dodge BuildShare, Dodge MarketShare, and the Sweets family of products. To learn more, visit www.construction.com.