Gains reported for nonresidential building, public works, electric utilities

The value of new construction starts in January climbed 12% to a seasonally adjusted annual rate of $690.2 billion, according to Dodge Data & Analytics. After losing momentum during last year’s fourth quarter, nonresidential building strengthened in January, with much of the lift coming from the start of the $3.4 billion Central Terminal Building at LaGuardia Airport in New York NY as well as groundbreaking for several other large airport terminal projects.

Nonbuilding construction bounced back from a subdued December, with the boost arising from a $750 million natural gas-fired power plant in Florida plus two pipeline projects – the $900 million Plains Diamond oil pipeline in Arkansas and Oklahoma, and the $767 million Presidio Crossing natural gas pipeline in Texas.

Meanwhile, residential building edged upward in January as the result of a slight gain for single family housing.

On an unadjusted basis, total construction starts in January were reported at $48.5 billion, down 3% from the same month a year ago which included especially strong amounts for the often volatile manufacturing plant and electric utility/gas plant categories. If manufacturing plants and electric utilities/gas plants are excluded, total construction starts in January would be up 10% from last year’s corresponding volume.

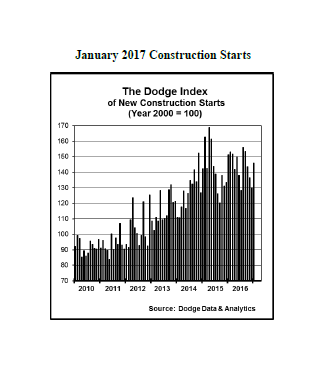

The January statistics raised the Dodge Index to 146 (2000=100), compared to 130 in December. The Dodge Index reached its 2016 peak in August at 156, and held close to that level in September at 153. The next three months showed the Dodge Index retreating 5% to 6% each month, culminating in December’s 130. For the full year 2016, the Dodge Index averaged 144. “The 12% gain for total construction starts in January gets 2017 off to a healthy beginning, following the declines reported toward the end of 2016,” stated Robert A. Murray, chief economist for Dodge Data & Analytics.

The January statistics raised the Dodge Index to 146 (2000=100), compared to 130 in December. The Dodge Index reached its 2016 peak in August at 156, and held close to that level in September at 153. The next three months showed the Dodge Index retreating 5% to 6% each month, culminating in December’s 130. For the full year 2016, the Dodge Index averaged 144. “The 12% gain for total construction starts in January gets 2017 off to a healthy beginning, following the declines reported toward the end of 2016,” stated Robert A. Murray, chief economist for Dodge Data & Analytics.

“What’s noteworthy about January’s rebound is that the institutional side of the nonresidential building market, led by airport terminal work, has assumed a more substantial role in keeping the expansion going,” Murray continued. “The institutional side of nonresidential building has typically lagged the pattern shown by commercial building, and its continued growth is needed for overall nonresidential building to advance further in 2017. While commercial building is also expected to see growth in 2017, its rate of increase will be restrained as vacancy rates level off and banks in the near term maintain a cautious stance towards commercial real estate loans pending any changes to the Dodd-Frank regulations. The public works sector is also anticipated to strengthen in 2017, with help coming from more pipeline work, although Congress needs to finalize fiscal 2017 appropriations which at the moment are set at essentially status quo levels under a continuing resolution that expires at the end of April. The proposal for greater infrastructure spending by the Trump Administration, assuming it gets passed in some form by Congress during this year’s first half, may not have a discernible impact on public works construction starts until the end of 2017 and into 2018.”

Nonresidential building

Nonresidential building in January climbed 16% to $261.5 billion (annual rate), following lackluster activity in December. The inclusion of the $3.4 billion Central Terminal Building project at LaGuardia Airport as a January start provided much of the upward push, supporting a 37% gain for the institutional categories as a group and a 768% hike for the transportation terminal category.

If the Central Terminal Building project is excluded, nonresidential building in January would have receded 2%, the institutional categories as a group would be down 1%, but the transportation terminal category would still have registered a 138% increase given the support coming from other large airport terminal projects. These included a $477 million project at San Francisco International Airport, a $420 million international arrivals facility at Seattle-Tacoma International Airport, and a $70 million expansion for Terminal 3 at Chicago’s O’Hare International Airport.

Also advancing in January were healthcare facilities, rising 6% with the help of these projects – the $239 million Banner University Medical Center in Phoenix AZ, the $230 million Westchester Medical Center ambulatory care pavilion in Valhalla NY, and a $135 million hospital modernization project in Galveston TX.

The public buildings category in January rose 1%, aided by the start of the $210 million Multnomah County Central Courthouse in Portland OR.

On the negative side for the institutional sector, January declines were reported for educational facilities, down 18%; amusement-related work, down 36%; and religious buildings, down 44%. Even with its January decline, the educational facilities category did include the start of several notable science-related university projects, such as a $252 million building at Stanford University in Palo Alto CA, a $143 million building at the University of Washington in Seattle WA, and a $117 million building at Penn State University in University Park PA.

The commercial side of the nonresidential building market grew 12% in January.

Office construction starts climbed 26%, and featured the start of two large data centers – a $600 million data center in McClellan CA and a $395 million data center in Sterling VA. Other large office projects reported as January starts were the $329 million office portion of a $355 million mixed-use building in Brooklyn NY, a $105 million office building in Austin TX, and a $100 million office building renovation in Washington DC.

Warehouse construction in January increased 21%, helped by groundbreaking for an $87 million distribution center for the U.S. Postal Service in Portland OR.

Hotel construction in January rose 5%, and included the start of a $160 million convention center hotel in Daytona Beach FL.

Declines in January were reported for store construction, down 1%; and commercial garages, down 7%.

The manufacturing plant category in January plunged 69% relative to December which included the start of a $1.2 billion pharmaceutical plant in Clayton NC. The largest manufacturing project reported as a January start was a $200 million pharmaceutical plant expansion in Waco TX.

Nonbuilding construction

Nonbuilding construction, at $121.1 billion (annual rate), rebounded 44% in January after plunging 40% in December.

The electric utility/gas plant category surged 285% following extremely low activity in December, lifted by the January start of a $750 million natural gas-fired power plant in Florida. January’s amount for this category was still weak by recent standards, coming in 65% below the average monthly pace for electric utilities/gas plants during 2016.

The public works categories as a group climbed 32% in January, led by a 222% surge for the miscellaneous public works category which includes pipelines, mass transit, and site work. The two large pipeline projects entered as January starts were the $900 million Plains Diamond oil pipeline in Arkansas and Oklahoma, and the $767 million Presidio Crossing natural gas pipeline in Texas.

Additional miscellaneous public works projects entered as January starts were a $321 million light rail project in Bellevue WA and a $142 million natural gas pipeline in Pennsylvania.

River/harbor development work in January bounced back 64% after December’s 75% plunge, and sewer construction improved 4% with the January start of a $137 million waste water treatment plant in Pennsylvania.

On the negative side, highway and bridge construction slipped 2% in January, maintaining the lackluster activity reported towards the end of 2016, although the latest month did include a $298 million HOV lane project on Interstate 5 in the San Diego CA area.

Water supply construction in January dropped 13% after soaring 57% in December.

Residential building

Residential building in January increased 1% to $307.6 billion (annual rate), basically maintaining the improved level achieved in December with an 8% gain.

Single family housing in January grew 1%, due to this pattern by major region – the Midwest, up 13%; the Northeast, up 7%; the South Atlantic and South Central, each up 2%; and the West, down 10%.

Multifamily housing in January held steady with its December amount. There were 13 multifamily projects valued at $100 million or more that reached groundbreaking in January, similar to the 14 such projects in December, including these January starts – the $615 million multifamily portion of the $650 million One Grant Park (phase 1) in Chicago IL, the $423 million City Point apartment building in Brooklyn NY, and the $282 million multifamily portion of the $345 million Jamaica Station development in Queens NY.

The top five metropolitan areas in terms of the dollar amount of multifamily starts in January were the following – New York NY, Chicago IL, Washington DC, San Jose CA, and Los Angeles CA.

The 3% decline for total construction starts on an unadjusted basis for January 2017 relative to January 2016 was the result of a varied performance by major sector. Nonresidential building advanced 27%, with institutional building up 74%, commercial building, up 14%, and manufacturing building down 72%. Residential building rose 1%, with single family housing up 7% and multifamily housing down 10%. Nonbuilding construction fell 37%, with public works down 14% and electric utilities/gas plants down 77%.

By geography, total construction starts for January 2017 relative to January 2016 revealed this pattern – the Northeast, up 22%; the West, up 21%; the South Atlantic, down 8%; the Midwest, down 14%; and the South Central, down 24%.

Useful perspective is made possible by looking at twelve-month moving totals, in this case the twelve months ending January 2017 versus the twelve months ending January 2016, which lessens the volatility present in one-month comparisons. For the twelve months ending January 2017, total construction starts were up 1%. By major sector, nonresidential building grew 5%, with commercial building up 12%, institutional building up 10%, and manufacturing building down 36%. Residential building also grew 5%, with single family housing up 8% and multifamily housing down 1%. Nonbuilding construction dropped 12%, with public works down 6% and electric utilities/gas plants down 26%.

| January 2017 Construction Starts | |||||||

| Monthly Summary of Construction Starts | |||||||

| Prepared by Dodge Data & Analytics | |||||||

| Monthly Construction Starts | |||||||

| Seasonally Adjusted Annual Rates, in Millions of Dollars | |||||||

| January 2017 | December 2016 | % Change | |||||

| Nonresidential Building | $261,465 | $225,933 | +16 | ||||

| Residential Building | 307,619 | 304,757 | +1 | ||||

| Nonbuilding Construction | 121,112 | 84,215 | +44 | ||||

| Total Construction | $690,196 | $614,905 | +12 | ||||

| The Dodge Index | |||||||

| Year 2000=100, Seasonally Adjusted | |||||||

| January 2017 .…….146 | |||||||

| December 2016.….130 | |||||||

| Year-to-Date Construction Starts | |||||||

| Unadjusted Totals, in Millions of Dollars | |||||||

| 1 Mo. 2017 | 1 Mo. 2016 | % Change | |||||

| Nonresidential Building | $18,927 | $14,891 | +27 | ||||

| Residential Building | 20,235 | 20,043 | +1 | ||||

| Nonbuilding Construction | 9,299 | 14,838 | -37 | ||||

| Total Construction | $48,461 | $49,772 | -3 | ||||

| Total Construction, excluding | |||||||

| manufacturing buildings and | |||||||

| electric utilities/gas plants | $46,649 | $42,288 | +10 | ||||

About Dodge Data & Analytics: Dodge Data & Analytics is a technology-driven construction project data, analytics and insights provider. Dodge provides trusted market intelligence that helps construction professionals grow their business, and is redefining and recreating the business tools and processes on which the industry relies. Dodge is creating an integrated platform that unifies and simplifies the design, bid and build process, bringing data on people, projects and products into a single hub for the entire industry, from building product manufacturers to contractors and specialty trades to architects and engineers. The company’s products include Dodge Global Network, Dodge PlanRoom, Dodge PipeLine, Dodge SpecShare, Dodge BuildShare, Dodge MarketShare, and the Sweets family of products. To learn more, visit www.construction.com.