Nonresidential building pulls back after a strong September

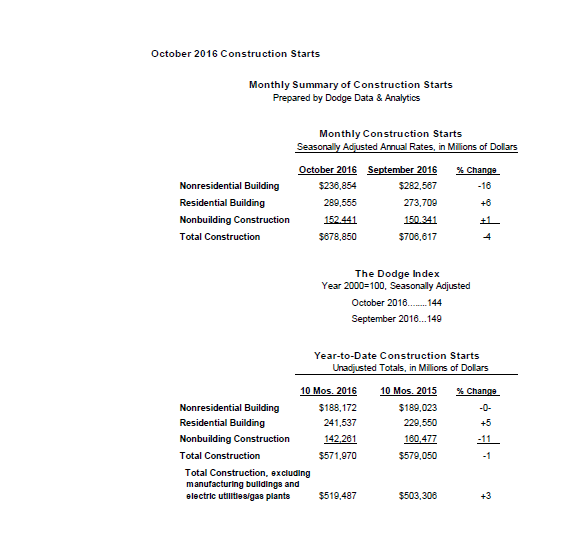

New construction starts in October decreased 4% to a seasonally adjusted annual rate of $678.9 billion, settling back from the elevated amount that was reported in September, according to Dodge Data & Analytics.

Nonresidential building retreated from its brisk September pace, which was this sector’s strongest volume so far in 2016. October’s level for nonresidential building was still healthy compared to what’s been reported for much of 2016 – while down 12% from its average for August and September, it remained 15% above its lackluster average for this year’s first seven months.

Residential building in October showed moderate growth, with contributions from both single family and multifamily housing.

Nonbuilding construction in October edged up slightly, as an increase for public works offset diminished activity for electric utilities/gas plants. The public works sector in October benefitted from the start of the $1.7 billion Mid-Coast Corridor Transit Project in San Diego CA and the $850 million State Highway 288 Tollway project in the Houston TX area. For the first ten months of 2016, total construction starts on an unadjusted basis were $572.0 billion, down a slight 1% from the same period a year ago. If the volatile manufacturing plant and electric utility/gas plant categories are excluded, total construction starts during this year’s January-October period would be up 3%.

October 2016 Construction Starts. Dodge Data & Analytics

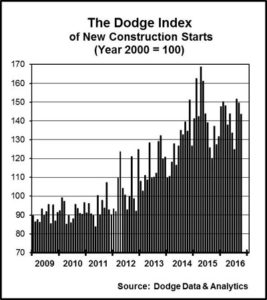

October’s data produced a reading of 144 for the Dodge Index (2000=100), compared to 149 in September and 152 in August. The quarterly averages for the Dodge Index in 2016 show the first quarter at 149, the second quarter at 138, and the third quarter at 142, with the average over the first nine months of the year coming in at 143. October’s pace for total construction starts, while down from August and September, is still up from the third quarter.

“After a sluggish second quarter, the pace of construction starts picked up during the third quarter, and on this basis October is at least maintaining recent improvement,” stated Robert A. Murray, chief economist for Dodge Data & Analytics. “While there was concern earlier in 2016 that the often hesitant expansion for construction could be stalling, the generally stronger activity in August, September, and now October eases those concerns. Furthermore, the year-to-date comparisons have strengthened as 2016 has proceeded, with total construction starts now down just 1% through the first ten months of this year. This compares with the 3% decline at the nine-month mark, the 7% decline at the eight-month mark, and the 11% decline at the seven-month mark. Aside from stronger activity during the most recent three months, the year-to-date comparisons are benefitting from last year’s pattern for total construction starts, which showed weaker activity in the second half. The first half of 2015 had been lifted by 13 very large projects valued each at $1 billion or more, while last year’s second half saw only three such projects reach the construction start stage.”

“On balance, the current year is turning out to be one where the overall level of construction starts is at least holding steady,” Murray continued. “Supportive elements are moderate job growth, generally healthy market fundamentals for commercial real estate, and the funding coming from the state and local bond measures passed in recent years. Going forward, the continued expansion for construction should be helped by the November 2016 passage of such bond measures as the $9 billion Proposition 51 in California for school construction, and the emphasis of the incoming Trump Administration on increased spending for infrastructure.”

Nonresidential building

Nonresidential building in October fell 16% to $236.9 billion (annual rate), following gains in August (up 40%) and September (up 5%).

The commercial building categories as a group were down 25% after surging 37% in September which reflected an especially strong month for new office projects.

October showed a 46% decline for office construction, following its 147% hike in September which featured the start of two massive office towers in New York City – the $2.0 billion 3 Hudson Yards Boulevard office building on Manhattan’s west side and the $1.5 billion One Vanderbilt Tower near Grand Central Station. While not the same scale as what took place in September, October did see the start of several large office projects, including the $700 million Gotham Center Towers in Long Island City NY, a $250 million Facebook data center in Los Lunas NM, and a $190 million office building in Denver CO.

October showed a 46% decline for office construction, following its 147% hike in September which featured the start of two massive office towers in New York City – the $2.0 billion 3 Hudson Yards Boulevard office building on Manhattan’s west side and the $1.5 billion One Vanderbilt Tower near Grand Central Station. While not the same scale as what took place in September, October did see the start of several large office projects, including the $700 million Gotham Center Towers in Long Island City NY, a $250 million Facebook data center in Los Lunas NM, and a $190 million office building in Denver CO.- Warehouse and store construction registered similar declines in October, sliding 10% and 11% respectively, although the warehouse category did include the start of a $165 million Amazon distribution center in Jacksonville FL.

- On the plus side, hotel construction grew 10% in October, helped by $141 million for the hotel portion of the $170 million Great Wolf Lodge Water Park Resort in LaGrange GA.

- Commercial garage construction jumped 29% in October, reflecting the start of a $300 million consolidated car rental facility at the Honolulu HI International Airport.

The institutional building categories as a group dropped 21% in October, following a 9% gain in September and a 21% hike in August.

- The educational facilities category fell 19%, although October did include these projects – the $160 million renovation and expansion of the Philadelphia Museum of Art in Philadelphia PA, a $125 million science and engineering research facility at the University of Texas at Arlington, and the $93 million renovation of the Museum of Modern Art in New York NY.

- Healthcare facilities plunged 47% after being lifted in September by the start of eight healthcare facilities valued each at $100 million or more. In contrast, October included just four such projects, led by the $300 million New York Methodist Hospital expansion in Brooklyn NY.

Of the smaller institutional categories, declines were reported in October for amusement-related work, down 4%; religious buildings, down 12%; and transportation terminals, down 15%.

The public buildings category in October registered a 16% gain, reflecting $100 million for phase 2 of the San Ysidro Border Station in San Ysidro CA.

The decline for total nonresidential building in October was cushioned by a 250% surge for the manufacturing plant category, boosted by the start of a $1.4 billion ethylene plant in Louisiana.

Residential building

Residential building, at $289.6 billion (annual rate), grew 6% in October.

Single family housing advanced 6%, strengthening after a 3% decline in September. By geography, single family housing in October showed increases in all five major regions – the South Central, up 10%; the Midwest, up 9%; the Northeast, up 6%; the West, up 4%; and the South Atlantic, up 3%.

Multifamily housing in October climbed 5%, strengthening moderately after an 18% slide in September. There were 11 multifamily projects valued at $100 million or more that reached groundbreaking in October (compared to five in September), led by a $275 million apartment building in Miami FL, a $218 million apartment building in Queens NY, and a $200 million condominium building in Sunny Isles Beach FL. Through the first ten months of 2016, the top five metropolitan markets ranked by the dollar amount of multifamily starts were – New York NY, Los Angeles CA, Miami FL, Chicago IL, and Washington DC. Metropolitan areas ranked 6 through 10 were Dallas-Ft. Worth TX, Boston MA, San Francisco CA, Atlanta GA, and Seattle WA.

Multifamily housing in October climbed 5%, strengthening moderately after an 18% slide in September. There were 11 multifamily projects valued at $100 million or more that reached groundbreaking in October (compared to five in September), led by a $275 million apartment building in Miami FL, a $218 million apartment building in Queens NY, and a $200 million condominium building in Sunny Isles Beach FL. Through the first ten months of 2016, the top five metropolitan markets ranked by the dollar amount of multifamily starts were – New York NY, Los Angeles CA, Miami FL, Chicago IL, and Washington DC. Metropolitan areas ranked 6 through 10 were Dallas-Ft. Worth TX, Boston MA, San Francisco CA, Atlanta GA, and Seattle WA.

Nonbuilding construction

Nonbuilding construction in October increased a slight 1% to $152.4 billion (annual rate), as a 21% gain for public works balanced a 46% drop for electric utilities/gas plants. The public works advance was led by a 168% surge for the “miscellaneous public works” category, which featured the start of the $1.7 billion Mid-Coast Corridor Transit Project in San Diego CA, which will extend trolley service in the San Diego area.

Highway and bridge construction in October slipped 4% after rising 16% in September which reflected the boost coming from the $916 million segment of the Loop 202 (South Mountain Freeway) project in the Phoenix AZ area. October did include the start of the $850 million State Highway 288 Tollway project in the Houston TX area.

The environmental public works categories weakened in October, with sewer systems down 8%, water supply systems down 14%, and river/harbor development down 19%.

The 46% drop for electric utilities/gas plants in October followed a sharp 219% increase in September, although October still included the start of several large projects, such as a $450 million wind farm in Missouri.

October 2016 Construction Starts. Dodge Data & Analytics

The 1% retreat for total construction starts on an unadjusted basis for the January-October period of 2016 came as the result of a varied pattern by major sector. Nonresidential building year-to-date matched the same period a year ago, with commercial building up 10%, institutional building even with last year, and manufacturing building down 36%. Residential building year-to-date rose 5%, with single family housing up 7% and multifamily housing up 1%. Nonbuilding construction year-to-date fell 11%, with public works down 3% and electric utilities/gas plants down 28%.

By geography, total construction starts during the first ten months of 2016 showed this performance relative to a year ago – the Midwest and West, each up 7%; the South Atlantic, up 6%; the Northeast, down 3%; and the South Central, down 18% (due to this region’s comparison to last year which included the start of several massive liquefied natural gas export terminals).

About Dodge Data & Analytics:

Dodge Data & Analytics is a technology-driven construction project data, analytics and insights provider. Dodge provides trusted market intelligence that helps construction professionals grow their business, and is redefining and recreating the business tools and processes on which the industry relies. Dodge is creating an integrated platform that unifies and simplifies the design, bid and build process, bringing data on people, projects and products into a single hub for the entire industry, from building product manufacturers to contractors and specialty trades to architects and engineers. The company’s products include Dodge Global Network, Dodge PlanRoom, Dodge PipeLine, Dodge SpecShare, Dodge BuildShare, Dodge MarketShare, and the Sweets family of products. To learn more, visit www.construction.com.