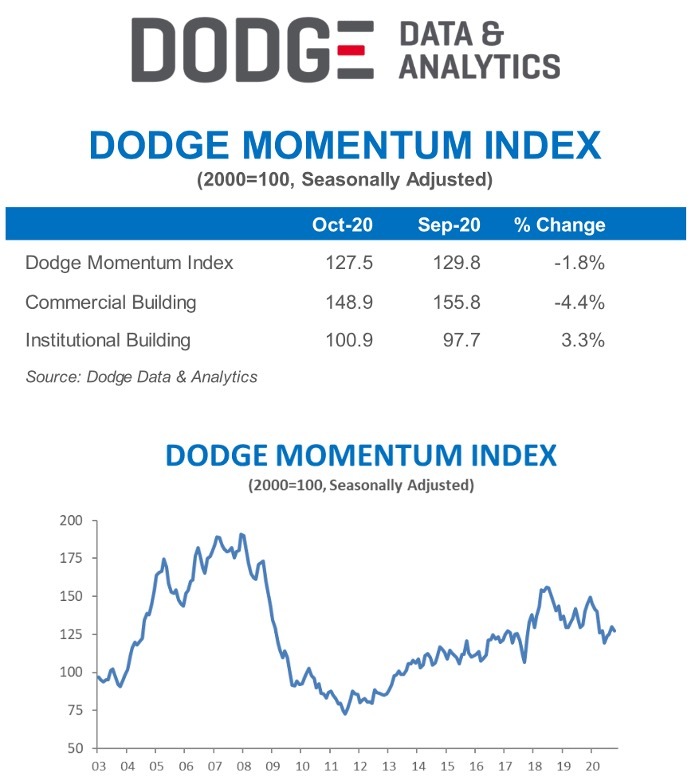

The Dodge Momentum Index fell 1.8% in October to 127.5 (2000=100) from the revised September reading of 129.8. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The commercial component of the Momentum Index lost 4.4% over the month, but the institutional component gained 3.3%.

The Momentum Index has struggled to make consistent gains since passing its post-pandemic low in June. Economic growth has slowed over the past few months, creating weaker demand for commercial projects. The fear about a new wave of COVID-19 infections may also be impeding planning activity in consumer-focused projects such as hotels and retail, although planning for warehouse projects continues to impress. Even with this month’s gain, the institutional component of the Momentum Index remains well below levels seen prior to the pandemic as state and local entities come to grips with the widening budget chasm.

In October, 10 projects each with a value of $100 million or more entered planning. The leading commercial projects were a $200 million office complex in New York NY and a $100 million Amazon warehouse in Spokane, WA. The leading institutional projects were two research labs valued at $300 million each, associated with the Dorchester Bay City project – a redevelopment of the Bayside Expo Center in Boston MA.