New construction starts in June decreased 7 percent from the previous month to a seasonally adjusted annual rate of $595.1 billion, according to Dodge Data & Analytics. The nonbuilding construction sector (public works and electric utilities) fell sharply after being lifted in May by the start of a $3.8 billion oil pipeline in the upper Midwest and seven large power plant projects totaling $4.3 billion.

Residential building in June edged down with reduced activity reported for both single family and multifamily housing. At the same time, nonresidential building registered moderate growth in June after sliding back in April and May.

Through the first six months of 2016, total construction starts on an unadjusted basis were $318.1 billion, down 11 percent from the same period a year ago.

- The January-June period of 2015 included 13 exceptionally large projects valued each at $1 billion or more, including a $9.0 billion liquefied natural gas export terminal in Texas, an $8.5 billion petrochemical plant in Louisiana, and two massive office towers in New York, N.Y. – the $2.5 billion 30 Hudson Yards and the $1.2 billion One Manhattan West.

- In contrast, the January-June period of 2016 included only four projects valued at $1 billion or more. If these exceptionally large projects are excluded, total construction starts during the first half of 2016 would be down a slight 2 percent from last year.

Dodge Data & Analytics new construction starts

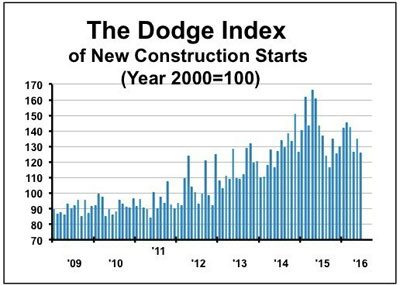

June’s data lowered the Dodge Index to 126 (2000=100), compared to 135 in May. After strengthening in this year’s first quarter, the Dodge Index fluctuated in the second quarter, rebounding in May after April’s decline, followed by another decline in June. “The construction start statistics on a monthly basis continue to show an up-and-down pattern,” stated Robert A. Murray, chief economist for Dodge Data & Analytics. “This has often been due to the presence or absence of very large projects for a given month, which most recently applies to the May and June behavior for public works and electric utilities.”

“Over a broader time frame, the year-to-date comparisons during the first half of 2016 were skewed by a number of exceptionally large projects (defined as projects valued at $1 billion or more) that reached the construction start stage in last year’s first half,” Murray continued. “There were fewer such projects during the second half of 2015, which should help the year-to-date comparisons as 2016 proceeds. In addition, last year’s third quarter witnessed a broader slowdown for construction starts, as investment grew more cautious due to mounting concerns about the global economy and the continued drop in energy prices at that time.

The generally weaker third quarter of 2015 will also help the year-to-date comparisons for construction starts as 2016 proceeds. While investment remains cautious, some uncertainty has been alleviated with energy prices stabilizing during this year’s first half. In addition, the anxiety created in late June by Great Britain’s vote to leave the European Union has eased, as shown by the recent rebound in stock prices. There continue to be several supportive factors worth noting for construction activity this year – long term interest rates have moved lower, commercial development is being financed by multiple sources, construction bond measures are providing funding for institutional building and public works projects, and the multiyear federal transportation bill is in place.”

Nonbuilding construction

Nonbuilding construction in June plummeted 24 percent to $145.7 billion (annual rate), reversing the 24 percent jump that had been reported in May.

The public works categories as a group fell 27 percent in June, pulled down by a 65 percent plunge for miscellaneous public works which includes oil and natural gas pipelines.

The public works categories as a group fell 27 percent in June, pulled down by a 65 percent plunge for miscellaneous public works which includes oil and natural gas pipelines.- The miscellaneous public works category in May was lifted by the start of the $3.8 billion Dakota Access Pipeline, which will connect the Bakken and Three Forks oil production areas in North Dakota to existing pipelines in Illinois. While miscellaneous public works did include several large projects as June starts, such as a $140 million rail extension project in Denver, Colo., they were not the same magnitude as the Dakota Access Pipeline reported for May.

- Sewer construction and water supply systems also registered declines in June, falling 13 percent and 29 percent respectively. River/harbor development posted a 13 percent gain in June, strengthening for the second month in a row after a weak April. Highway and bridge construction in June edged up 2 percent, lifted by a $600 million segment of the $1.5 billion Project Neon freeway expansion in Las Vegas, Nev.

Through the first six months of 2016, the top five states ranked by the dollar amount of highway and bridge construction starts were Texas, California, North Carolina, Florida, and Illinois. States ranked six through ten during this period were New York, Pennsylvania, Ohio, Nevada, and Virginia.

The electric utility and gas plant category in June fell 18 percent following its 57 percent increase in May. June included the start of three large natural-gas fired power plants located in Tennessee ($975 million), New York ($900 million), and New Jersey ($600 million), as well as a large wind farm in Iowa ($900 million). While substantial, the sum of these four large power-related projects at $3.4 billion was less than the $4.3 billion for seven large power-related projects in May.

Residential building

Residential building, at $268.6 billion (annual rate) slipped 2 percent in June, with slightly diminished activity for both single family and multifamily housing relative to May. Single family housing in June settled back 1 percent, which essentially maintains the plateau that’s been present in the first half of 2016 after the improved activity registered during the closing months of 2015.

The first half of 2016 showed this regional pattern for the dollar amount of single family construction compared to last year – the Midwest, up 14 percent; the Northeast, up 9 percent; the South Atlantic and West, each up 8 percent; and the South Central, up 3 percent. Multifamily housing in June retreated 5 percent after climbing 16 percent in May.

The first half of 2016 showed this regional pattern for the dollar amount of single family construction compared to last year – the Midwest, up 14 percent; the Northeast, up 9 percent; the South Atlantic and West, each up 8 percent; and the South Central, up 3 percent. Multifamily housing in June retreated 5 percent after climbing 16 percent in May.

There were ten multifamily projects valued each at $100 million or more that reached groundbreaking in June, led by the $493 million multifamily portion of the $600 million Century Plaza mixed-use development in Century City, Calif.; two apartment towers in Brooklyn, N.Y. valued at $228 million and $181 million respectively; and a $170 million apartment tower in Jersey City, N.J.

Through the first six months of 2016, New York, N.Y. continued to be the leading metropolitan area in terms of the dollar amount of multifamily starts, followed by Los Angeles, Calif.; Miami, Fla.; Chicago, Ill.; and Boston, Mass. Metropolitan areas ranked six through ten during this period were Washington D.C., San Francisco, Calif.; Dallas-Ft. Worth, Texas; Atlanta, Ga.; and Denver, Colo. Of these ten metropolitan areas, seven showed greater activity compared to a year ago, while three showed declines – New York, N.Y., down 27 percent; Washington D.C., down 18 percent; and Denver, Colo., down 2 percent.

Nonresidential building

Nonresidential building in June grew 6 percent to $180.8 billion (annual rate), strengthening after its April and May declines. The commercial categories as a group rose 9 percent in June, with the upward push coming from hotels and office buildings.

- Hotel construction advanced 36 percent after a weak May, boosted by a $128 million Marriott hotel in Nashville, Tenn., the $106 million hotel portion of a $230 million mixed-use development in Washington D.C. and a $100 million convention center hotel in Des Moines, Iowa.

- Office construction increased 19 percent in June, led by four large projects – a $172 million addition to the Fannie Mae headquarters in Washington D.C., a $150 million renovation of Nova Place in Pittsburgh, Pa.; a $150 million addition to a U.S. Army building at Fort Belvoir, Va.; and a $120 million office building in Washington D.C.

During the first six months of 2016, the top five metropolitan areas in terms of the dollar amount of office starts were New York, N.Y.; Washington D.C.; Dallas-Ft. Worth, Texas; San Francisco, Calif.; and Atlanta, Ga. Metropolitan areas ranked six through ten during this period were Boston, Mass.; Los Angeles, Calif.; Seattle, Wash.; Reno, Nev.; and Chicago, Ill.

Stores and warehouses both retreated in June, sliding 4 percent and 17 percent respectively. The manufacturing plant category weakened further in June, falling 29 percent.

The institutional side of the nonresidential building market increased 7 percent in June, reflecting a mixed pattern by project type.

The institutional side of the nonresidential building market increased 7 percent in June, reflecting a mixed pattern by project type.

- Healthcare facilities climbed 22 percent, boosted by three large hospital addition projects, located in Toledo, Ohio ($350 million); Bryn Mawr, Pa. ($150 million); and the Fayetteville, Ark. area ($127 million).

- Educational facilities edged up 1 percent from May’s pace, helped by such projects as the $213 million renovation of the Cincinnati, Ohio Museum Center at Union Terminal; a $98 million high school in Pittsfield, Mass.; and a $92 million training center for Southwest Airlines in Dallas, Texas.

- The relatively small transportation terminal category jumped 95 percent from a weak May, and included a $78 million train station renovation project in Queens, N.Y.

- Losing momentum in June were public buildings (courthouses and detention facilities), down 4 percent; churches, down 18 percent; and amusement-related projects, down 23 percent.

The 11 percent drop for total construction starts on an unadjusted basis during the January-June period of 2016 reflected reduced activity for both nonbuilding construction and nonresidential building, relative to their elevated pace of a year ago.

- Nonbuilding construction fell 22 percent year-to-date, with public works down 15 percent and electric utilities/gas plants down 33 percent. Nonresidential building fell 19 percent year-to-date, with commercial building down 7 percent, institutional building down 12 percent, and manufacturing building down 70 percent.

- Residential building continues to be the one major sector that’s advancing year-to-date, rising 4 percent, with an 8 percent gain for single family housing outweighing a 4 percent decline for multifamily housing.

By geography, total construction starts during the first six months of 2016 showed this pattern compared to last year – the South Central, down 32 percent; the Northeast, down 11 percent; the West, down 3 percent; the South Atlantic, down 1 percent; and the Midwest, up 5 percent.

| June 2016 Construction Starts | ||||||||

| Monthly Summary of Construction Starts | ||||||||

| Prepared by Dodge Data & Analytics | ||||||||

| Monthly Construction Starts | ||||||||

| Seasonally Adjusted Annual Rates, in Millions of Dollars | ||||||||

| June 2016 | May 2016 | % Change | ||||||

| Nonresidential Building | $180,828 | $169,877 | +6 | |||||

| Residential Building | 268,581 | 274,610 | -2 | |||||

| Nonbuilding Construction | 145,672 | 192,914 | -24 | |||||

| Total Construction | $595,081 | $637,401 | -7 | |||||

| The Dodge Index | ||||||||

| Year 2000=100, Seasonally Adjusted | ||||||||

| June 2016.……..126 | ||||||||

| May 2016………135 | ||||||||

| Year-to-Date Construction Starts | ||||||||

| Unadjusted Totals, in Millions of Dollars | ||||||||

| 6 Mos. 2016 | 6 Mos. 2015 | % Change | ||||||

| Nonresidential Building | $93,889 | $115,849 | -19 | |||||

| Residential Building | 139,537 | 134,076 | +4 | |||||

| Nonbuilding Construction | 84,713 | 108,113 | -22 | |||||

| Total Construction | $318,139 | $358,038 | -11 | |||||

| Total Construction, excluding | ||||||||

| projects valued at | ||||||||

| $1 billion or greater | $304,409 | $311,688 | -2 | |||||

About Dodge Data & Analytics: Dodge Data & Analytics is a technology-driven construction project data, analytics and insights provider. Dodge provides trusted market intelligence that helps construction professionals grow their business, and is redefining and recreating the business tools and processes on which the industry relies. Dodge is creating an integrated platform that unifies and simplifies the design, bid and build process, bringing data on people, projects and products into a single hub for the entire industry, from building product manufacturers to contractors and specialty trades to architects and engineers. The company’s products include Dodge Global Network, Dodge SpecShare, Dodge BuildShare, Dodge MarketShare, and the ConstructionPoints and Sweets family of products. To learn more, visit www.construction.com.

SOURCE Dodge Data & Analytics