U.S. cities seeking to drive growth and gain a competitive edge could find substantial opportunity in redeveloping surplus industrial land, and some cities are in a better position than others to cash in on the potential.

The rewards can be lucrative: Ongoing sources of revenue generation, increased tax base and job creation, according to a new report by Arcadis, a design and consultancy firm for natural and built assets.

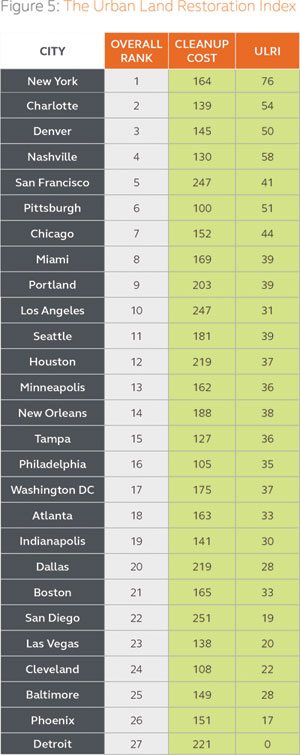

The cities’ Urban Land Restoration Index (ULI) is based on the cost of cleanup (remediation) to address environmental issues; the current or future potential value of the land itself; and, a factor called city “dynamism”—a reflection of the attractiveness, growth potential, real estate performance, resilience, and business environment that drive competitive advantage for cities.

The Arcadis Urban Land Restoration Index ranks the development potential of environmentally impaired land across 27 US cities. New York tops the ranking, boosted by its strength, continuing dynamic growth and relatively low costs to clean up land negatively impacted by its industrial past. It ranks the highest for redevelopment across commercial, residential and industrial properties.

Based on research by New York City’s Office of Environmental Remediation, the potential annual benefits to the city from its program alone are massive–$2.2 billion in new capital investment, 6 million square feet of new building space, 2,200 new permanent jobs, 6,500 construction jobs, 1,000 new affordable housing units, and $350 million in tax revenue.

Thriving smaller cities such as Charlotte, Denver and Nashville are ranked in the top five, due to strong potential and prime opportunities for developers seeking to capitalize on the demand for modern urban spaces. The massive growth of the financial services sector in Charlotte and a strong technology and telecom sector in Denver have helped elevate those cities’ potential for redevelopment.

The index analyzes three key factors which play a significant role in the restoration and redevelopment of an industrial property—the cost of cleanup (remediation) to address environmental issues; the current or future potential value of the land itself; and, a more abstract but critically important factor referred to as city “dynamism,” which is a reflection of the attractiveness, growth potential, real estate performance, resilience, and business environment that drive competitive advantage for cities.

Industrial property owners are sitting on large tracts of environmentally impaired land in cities across the country,” said Kurt Beil, global leader for Environmental Restoration at Arcadis.

With the right strategy and investment, these properties can be cleaned up and redeveloped to meet the ever-increasing demand for productive residential, commercial, and industrial land, Beil said. “Unlocking the hidden and untapped value of industrial land could drive growth and transform communities across the US.”

Arcadis said the index, by enabling industrial land owners, city leaders and developers to focus on common opportunities, will help unlock the potential of surplus industrial properties.

“Unlocking and maximizing the value of urban industrial land requires two things—a clear surplus-property strategy and a plan to integrate sustainable urban planning, financing, community engagement, restoration, redevelopment, and program delivery,” Beil said.

The full report is available here.

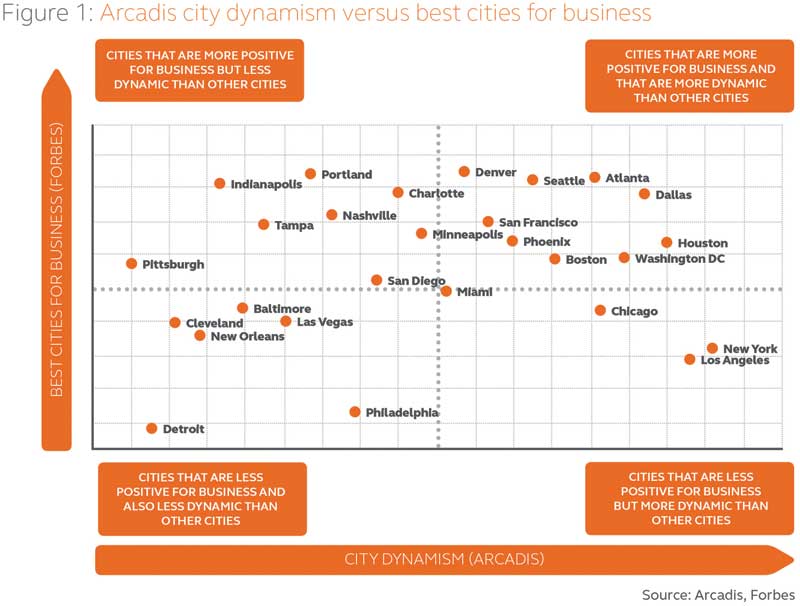

The “dynamism” of the cities and their business friendliness figure into their evaluations as depicted on this grid.