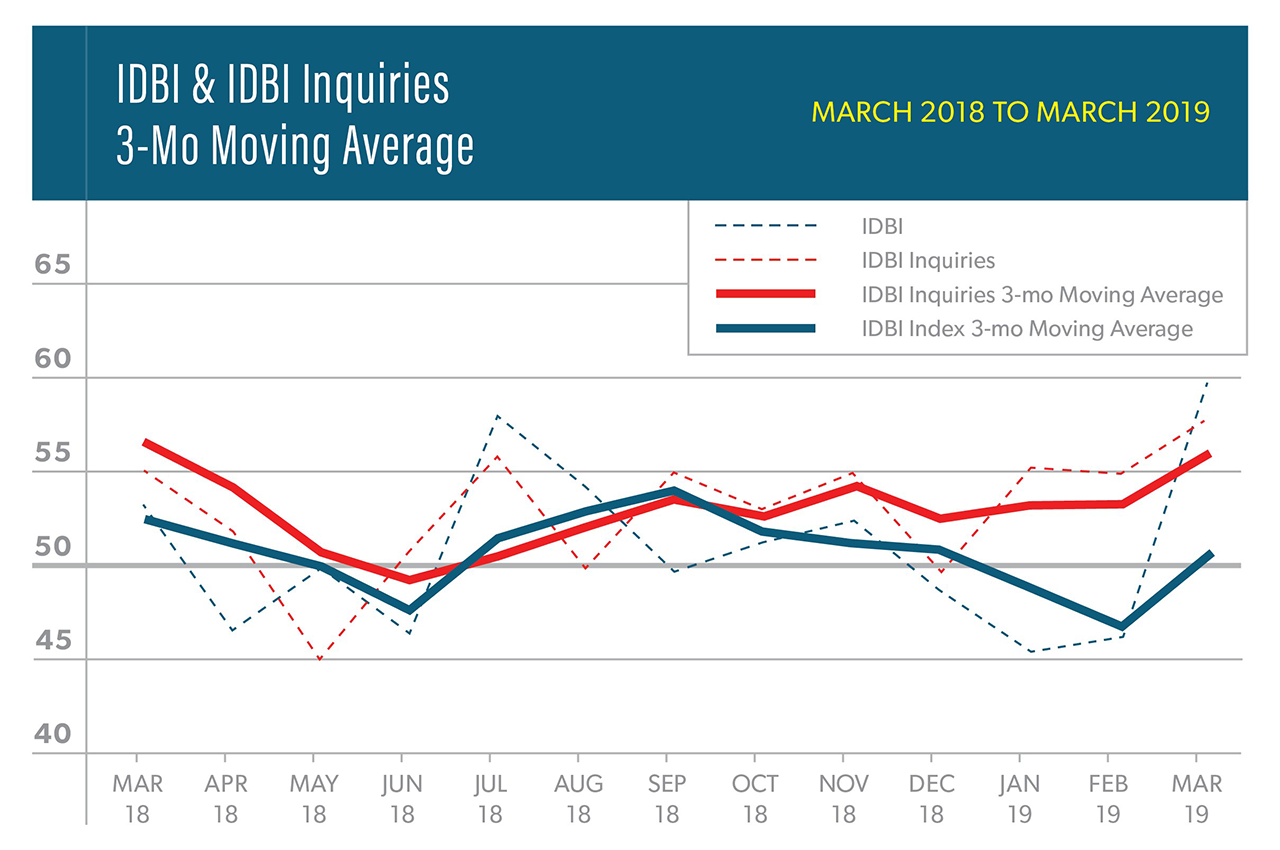

Billings at American Society of Interior Designers (ASID) member-owned interior design firms saw a healthy jump in March, a positive sign as firms enter what is traditionally a seasonal upswing. The March Interior Design Billings Index (IDBI) score of 60.4 indicates demand has strengthened (any score above 50 signifies growth) and is at its highest level since May 2017. The March three month moving average score of 50.7 is identical to December’s figure, suggesting that on average, the industry sustained significant economic activity during the early months of 2019.

ASID Interior Design Billings Index (IDBI) – March 2019

The outlook is also healthy as inquiries into new work are very positive with a score of 57.8. At 59.4, the March six-month outlook score is the strongest, most optimistic outlook since June 2018. The design industry remains optimistic about the short-term business conditions with 93 percent of respondents believing conditions will either be about the same or better than they are now.

Interior designers in all regions showed improvement in March billings with scores above 50, exceeding February scores (Northeast- 52.8, South- 51.2, Midwest- 51.1, West- 50.4).

Optional Bonus Questions for February: Investment in Firm Operations

This month’s special question asked our survey panelists about any recent investments they made in operations and if the new tax legislation influenced their decision-making process. Types of investments made include new staffing, new offices, automobiles, printers (high speed), computers and software, and new marketing. Of the survey respondents, 46 percent of interior designers made investments in their business compared to 40 percent at the same time a year ago. Eleven percent made what they considered to be substantial investments which indicate a belief in the future of their business. However, the new tax legislation passed in December 2017 was not a major part of the investment decision; of the firms making investments in their businesses, only 11 percent did so due to the new tax legislation.