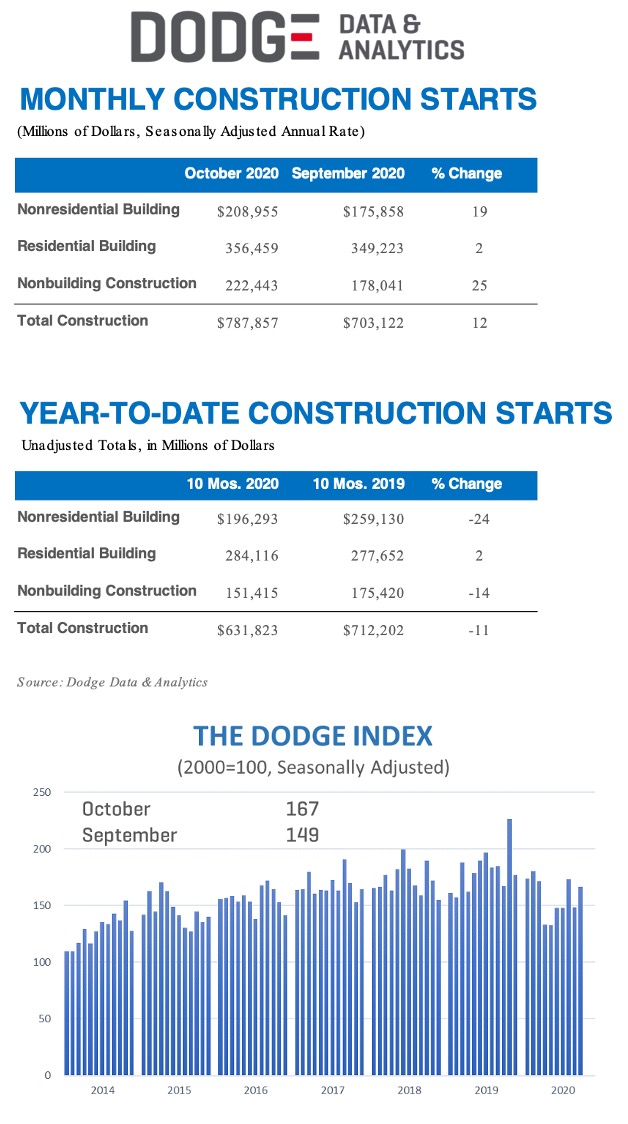

Total construction starts rose 12% in October to a seasonally adjusted annual rate of $787.9 billon. While sizeable, the increase does not erase September’s substantial pullback in starts. All three major categories moved higher over the month, nonbuilding starts rose 25%, nonresidential buildings increased 19%, while residential activity gained 2%. Four of the five regions saw construction starts move higher in October, with the only decline coming in the South Central region.

Through the first 10 months of 2020, total construction starts were 11% lower than the same period of 2019. Nonresidential starts were 24% lower and nonbuilding were down 14%. Residential starts, however, were 2% higher in the first 10 months of this year. For the 12 months ending October 2020, total construction starts were down 6% compared to the previous 12 months. Nonresidential building starts were 17% lower and nonbuilding starts were 7% lower, while residential building starts rose 4% over the 12 months ending October 2020. In October, the Dodge Index rose 12% to 167 (2000=100) from the reading of 149 in September. The Dodge Index was flat on a year-over-year basis, and 8% lower than its pre-pandemic level in February.

“October’s gain was welcome news following the large step back in starts during the previous month,” stated Richard Branch, Chief Economist for Dodge Data & Analytics. “The month’s increase, however, does not mean all is well with the economy and construction sector. The economy lost traction as the stimulus provided by the CARES Act ended. With the next wave of COVID-19 infections looming, the economy will continue to lose steam until more fiscal stimulus is provided and a vaccine has been widely adopted. Until that has occurred, the construction sector will continue to be volatile.”

Nonbuilding construction posted a solid 25% gain in October, increasing to a seasonally adjusted annual rate of $222.4 billion. The gain was driven in large part by a sizeable tunnel project that drove highway and bridge starts 51% higher. The utility/gas plant category rose 41%, while miscellaneous nonbuilding gained 6%. Environmental public works fell 24% over the month.

The largest nonbuilding project to break ground in October was the $3.6 billion Hampton Roads Bridge and Tunnel project in Norfolk VA. Also starting in October was the $1.0 billion Gemini Solar Project in Clark County NV and the $450 million Indiana Crossroads Wind Farm in White County IN.

Through the first 10 months of the year, total nonbuilding starts were down 14% from the same time period of 2019. Starts in the highway and bridge category were up 8%, while environmental public works were 8% lower. The miscellaneous nonbuilding and utility/gas plant categories were each down 34% year-to-date. For the 12 months ending October 2020, total nonbuilding starts were down 7% from the 12 months ending October 2019. Street and bridge starts were 8% higher, while utility/gas plant starts were down 14%. Environmental public works starts were down 5% and miscellaneous nonbuilding starts were 29% lower in the 12 months ending October 2020.

Nonresidential building starts recovered slightly from the sharp September decline, gaining 19% in October to a seasonally adjusted annual rate of $209.0 billion. Several large office and warehouse projects got underway during the month pushing commercial starts up 23%. Manufacturing starts gained 26% during the month, while a large courthouse project helped institutional starts gain 15%.

The largest nonresidential building project to get started in October was the $585 million third phase of the Project Echo Facebook Data Center in Sandston VA. Also getting started during the month was the $400 million Tesla Gigafactory in Austin TX and the $330 million Campus at Horton office project in San Diego CA.

Total nonresidential building starts were down 24% through the first 10 months of 2020. Commercial starts were 27% lower and institutional starts were 16% lower, while manufacturing starts tumbled 54%. For the 12 months ending October 2020, total nonresidential building starts were down 17%. Institutional building starts fell 13%, commercial starts dropped 20%, and manufacturing starts declined 22% over the 12 months ending October 2020.

Residential building starts moved 2% higher in October to a seasonally adjusted annual rate of $356.5 billion. The increase in the multifamily sector was robust, with starts rising 62% following a 52% loss the previous month. Single family starts fell 9% in October.

The largest multifamily building to break ground in October was the $386 million Waterview at Greenpoint project in Brooklyn NY. Also starting were a $250 million mixed-use project on 47th Street in New York NY and a $200 million residential tower on High Street in Houston TX.

Through the first 10 months of 2020, residential construction starts were 2% higher than in the same time period of 2019. Single family starts were up 8%, but multifamily starts were down 11%. For the 12 months ending in October, total residential starts were 4% higher than in the 12 months ending October 2019. Single family starts were up 8%, while multifamily starts were down 5%.

About Dodge Data & Analytics: Dodge Data & Analytics is North America’s leading provider of analytics and software-based workflow integration solutions for the construction industry. Building product manufacturers, architects, engineers, contractors, and service providers leverage Dodge to identify and pursue unseen growth opportunities and execute on those opportunities for enhanced business performance. Whether it’s on a local, regional or national level, Dodge makes the hidden obvious, empowering its clients to better understand their markets, uncover key relationships, size growth opportunities, and pursue those opportunities with success. The company’s construction project information is the most comprehensive and verified in the industry. Dodge is leveraging its 100-year-old legacy of continuous innovation to help the industry meet the building challenges of the future. To learn more, visit www.construction.com.

Related: Construction starts fall 18% in September