The kitchen and bathroom makeover remain highly popular with homeowners, but a stronger economy has revived the market for whole-house remodels and other big-ticket upgrades.

A quarterly survey issued by NAHB Remodelers—a division of the National Association of Home Builders—finds that whole-house remodels have increased by 10 percent from 2013. Room additions also have shown strength, rising by 12 percent, while finished basements rose 8 percent and bathroom additions are up 7 percent.

“While bathroom and kitchen remodels remain the most common renovations, basements, whole house remodels and both large and small scale additions are returning to levels not seen since prior to the downturn,” said 2016 NAHB Remodelers Chair Tim Shigley, a remodeling contractor in Wichita, Kan.

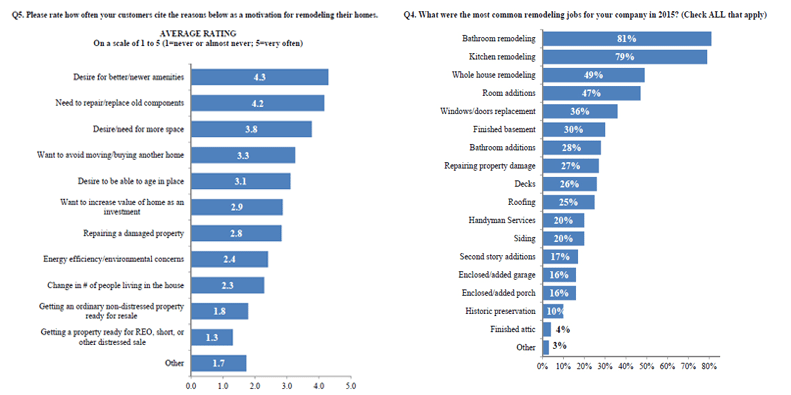

Bathrooms topped the list of most common remodeling projects for the fifth time since 2010. Eighty-one percent of remodelers reported that bathrooms were a common remodeling job for their company, while 79 percent of remodelers reported the same for kitchen remodels. Window and door replacements decreased to 36 percent from 45 percent in 2014.

Bathrooms topped the list of most common remodeling projects for the fifth time since 2010. Eighty-one percent of remodelers reported that bathrooms were a common remodeling job for their company, while 79 percent of remodelers reported the same for kitchen remodels. Window and door replacements decreased to 36 percent from 45 percent in 2014.

The quarterly survey of NAHB Remodelers member companies asked a series of “special questions” related to the most common remodeling jobs in 2016, in addition to asking remodeling companies about current market conditions.

In an earlier announcement, NAHB Remodelers said the Remodeling Market Index (RMI), based on the survey, posted a reading of 54 for the first quarter of 2016, down four points from the previous quarter but still well above a reading of 50 that indicates higher market activity.

The overall RMI averages ratings of current remodeling activity with indicators of future remodeling activity. NAHB Chief Economist Robert Dietz said the organization anticipates “modest growth in the remodeling industry over the course of 2016.”

Crunching the remodeling numbers

As the accompanying chart shows, bathroom and kitchen remodeling remain the dominant type of project in demand by homeowners, followed by whole-house remodeling and room additions. These types of projects have made up a big portion of remodelers’ work portfolios for years, according to NAHB survey figures.

Whole-house remodeling, on the other hand, fell as a percentage of remodelers’ workloads between 2010 and 2012, hitting a low of 21 percent in the second quarter of 2010. A similar trend was evident in the room-addition category during the post-recession doldrums that were characterized by sluggish economic recovery.

Whole-house remodeling, on the other hand, fell as a percentage of remodelers’ workloads between 2010 and 2012, hitting a low of 21 percent in the second quarter of 2010. A similar trend was evident in the room-addition category during the post-recession doldrums that were characterized by sluggish economic recovery.

Asked about reasons customers cite as motivation for remodeling, “Desire for better/newer amenities comes out on top—4.3 on a scale of 1 (lowest) to 5 (highest), followed by “Need to repair/replace old components” and “Desire/need for more space.”

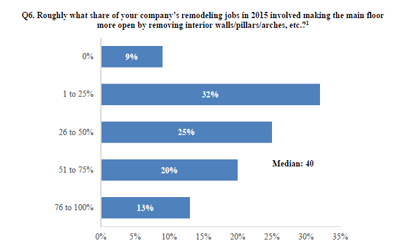

The survey also asked remodelers about the share of their jobs in 2015 that involved making the main floor “more open.” This type of project made up a considerable portion of workloads—as much as 51-75 percent of some remodelers (20 percent) and even 76-100 percent for a few contractors—13 percent.

RMI market tables: www.nahb.org/rmi.

NAHB Remodelers: www.nahb.org/remodel.