Annual total for 2016 edges up one percent to $676.5 billion

New construction starts in December slipped 5% to a seasonally adjusted annual rate of $613.0 billion, according to Dodge Data & Analytics. The latest month’s decline for total construction was due to sharply reduced activity for the nonbuilding construction sector, reflecting further erosion by public works as well as a steep plunge by the electric utility/gas plant category. At the same time, nonresidential building in December held steady with its November pace, and residential building was able to register moderate growth.

For all of 2016, total construction starts advanced 1% to $676.5 billion, a considerably smaller gain than the 11% increase reported for 2015. If the volatile manufacturing plant and electric utility/gas plant categories are excluded, total construction starts in 2016 would be up 4%, depicting a more gradual deceleration relative to the corresponding 9% increase in 2015.

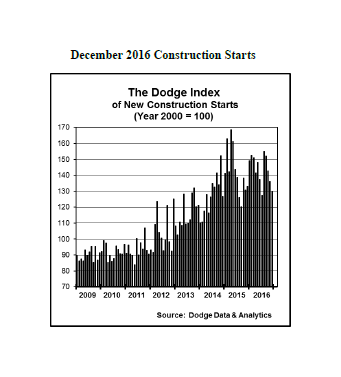

The December statistics produced a reading of 130 for the Dodge Index (2000=100), down from a revised 136 for November. For the full year 2016, the Dodge Index averaged 143. “The construction start statistics over the course of 2016 revealed a varied pattern, with the end result being a slight gain for the year as a whole,” stated Robert A. Murray, chief economist for Dodge Data & Analytics. “On a quarterly basis, growth was reported during the first and third quarters, while activity settled back during the second and fourth quarters. On the plus side for 2016, commercial building continued to rise, and institutional building provided evidence that it was beginning to regain upward momentum after pausing in 2015. Single family housing showed moderate improvement, while multifamily housing witnessed growth in numerous markets with the notable exception of New York NY, which retreated after the robust activity reported in 2015. On the negative side, public works settled back in 2016, and steep declines were reported for manufacturing plants and the gas plant portion of the electric utility/gas plant category.”

The December statistics produced a reading of 130 for the Dodge Index (2000=100), down from a revised 136 for November. For the full year 2016, the Dodge Index averaged 143. “The construction start statistics over the course of 2016 revealed a varied pattern, with the end result being a slight gain for the year as a whole,” stated Robert A. Murray, chief economist for Dodge Data & Analytics. “On a quarterly basis, growth was reported during the first and third quarters, while activity settled back during the second and fourth quarters. On the plus side for 2016, commercial building continued to rise, and institutional building provided evidence that it was beginning to regain upward momentum after pausing in 2015. Single family housing showed moderate improvement, while multifamily housing witnessed growth in numerous markets with the notable exception of New York NY, which retreated after the robust activity reported in 2015. On the negative side, public works settled back in 2016, and steep declines were reported for manufacturing plants and the gas plant portion of the electric utility/gas plant category.”

“In a broad sense, construction activity shifted to a more mature stage of expansion in 2016, characterized by a slower rate of growth for total construction compared to the 10% to 12% gains of the previous four years,” Murray continued. “For 2017, more growth at a moderate pace is expected for total construction. Commercial building has yet to see much in the way of rising vacancy rates, and the institutional building sector will be helped by the passage of such recent bond measures as the $9 billion Proposition 51 in California. Manufacturing plant construction should turn upward, no longer exerting a downward pull on overall construction activity. Despite rising mortgage rates, housing should benefit from greater demand coming from an increasing number of millennials moving into their thirties. And, public works will be supported by recent bond measures passed at the state level, although Congress will need to revisit the flat federal funding for highways under the current continuing resolution that expires at the end of April. Additional support for public works will depend on how Congress responds to the proposals by the Trump Administration for more infrastructure spending, including incentives to spur private investment.”

Nonresidential building

Nonresidential building in December was reported at $224.0 billion (annual rate), basically unchanged from November.

- The manufacturing plant category jumped 124%, bouncing back from a weak November with the lift coming from the start of a $1.2 billion pharmaceutical plant in Clayton NC.

- The commercial categories as a group advanced 11% in December, making a partial rebound after falling 20% in the previous month.

- Hotel construction climbed 74%, reflecting the start of the $164 million hotel portion of the $500 million Skyplex Entertainment Complex in Orlando FL and a $138 million hotel at New York’s JFK International Airport (as part of the conversion of the historic TWA Flight Center building).

- Office construction in December increased 25%, boosted by the start of two large data centers in Aurora IL ($255 million) and Ashburn VA ($160 million), as well as by the start of a $117 million renovation project at Rockefeller Center in New York NY.

- Smaller gains in December were reported for commercial garages, up 13%; and stores, up 8%.

- Warehouse construction was the one commercial project type to retreat in December, falling 35%.

The institutional building categories as a group dropped 17% in December.

- Amusement-related construction plunged 70%, following its elevated activity in November that included the start of the $3.0 billion football stadium for the Los Angeles Rams in Inglewood CA. Despite the steep decline, the amusement category did include two noteworthy projects as December starts – the $242 million amusement park portion of the Skyplex Entertainment Complex in Orlando FL and a $130 million student recreation/aquatics center at San Jose State University in San Jose CA.

- Reduced activity was also reported in December for public buildings (courthouses and detention facilities), down 17%; and healthcare facilities, down 12%.

On the plus side, the educational facilities category jumped 34% in December, reaching its highest amount in 2016. Large projects that supported the increase for educational facilities were the $150 million renovation of a marine research center in Los Angeles CA, a $117 million research building for the University of California at Riverside, and an $84 million renovation of an elementary school in the Bronx NY.

Transportation terminal work grew 20% in December, aided by the start of a $120 million expansion to Concourse A North at the Charlotte Douglas International Airport in Charlotte NC.

The religious building category bounced back 87% in December from an extremely weak November amount.

For 2016 as a whole, nonresidential building advanced 4% to $227.7 billion, regaining upward momentum after slipping 2% in 2015. Over the past two years the percent change for nonresidential building has been dampened by substantial declines for the manufacturing plant category, which plunged 32% in 2015 and then another 27% in 2016. The weaker performance by manufacturing plants reflected in particular a pullback for new petrochemical plant starts after the exceptional amount that was reported back in 2014. If the manufacturing plant category is excluded, nonresidential building in 2016 would show a 7% increase, slightly stronger than the corresponding 4% gain in 2015.

The commercial categories as a group in 2016 climbed 11%, a faster rate of growth than the 7% rise in 2015. Leading the way in 2016 was office construction, increasing 21% as it continues to move upward from the extremely low amounts reported during the years immediately following the recession.

- Large office projects that reached groundbreaking in 2016 included the following – the $2.0 billion 3 Hudson Boulevard office building in New York NY, the $1.5 billion One Vanderbilt Tower also in New York NY, the $700 million Gotham Center Towers in Long Island City NY, a $400 million data center in Grand Rapids MI, and a $293 million portion of the Toyota Corporate Campus in Plano TX.

- The top five metropolitan areas in 2016 ranked by the dollar amount of new office starts, with their percent change from the prior year, were the following – New York NY, down 2%; Washington DC, up 87%; Dallas-Ft. Worth TX, up 31%; Chicago IL, up 22%; and Seattle WA, up 54%.

Hotel construction in 2016 advanced 19%, matching its rate of growth in the previous year. Large hotel projects that reached groundbreaking in 2016 included the $465 million hotel portion of the $1.7 billion Wynn Casino in the Boston MA area, the $357 million hotel portion of the $530 million Gaylord Rockies Resort and Convention Center in Aurora CO, and the $332 million hotel portion of the $630 million Montreign Resort and Casino in Kiamesha Lake NY.

Warehouse construction in 2016 improved 8%, continuing the upward trend that’s been present since 2011, and commercial garages grew 13%. Store construction was the one commercial project type not able to register an increase in 2016, sliding 8% as its subdued recovery of the previous five years stalled.

The institutional categories as a group increased 4% in 2016 following the slight 1% gain reported in 2015.

Educational facilities, the largest institutional category, rose 3% with the upward push coming from K-12 schools while college/university construction settled back from earlier gains. The top five states for K-12 school construction in 2016, with their percent change from the prior year, were the following – Texas, up 24%; New York, down 5%; California, up 30%; Washington state, down 4%; and Minnesota, up 44%.

Healthcare facilities grew 9% in 2016, led by such projects as the $631 million Loma Linda University Medical Center in Loma Linda CA and the $500 million Vassar Brothers Medical Center patient pavilion in Poughkeepsie NY.

As for the smaller institutional categories, amusement-related construction posted a sizeable 25% gain in 2016, aided by such projects as the $3.0 billion football stadium for the Los Angeles Rams and the $974 million casino portion of the Wynn Casino.

The transportation terminal category climbed 18% in 2016, with the lift coming from such projects as the $663 million rail terminal cavern work at Grand Central Terminal in New York NY and the $537 million North Terminal building at Louis Armstrong International Airport in New Orleans LA. On the negative side, 2016 declines were reported for public buildings, down 3%; and religious buildings, down 28%.

Residential building

Residential building in December climbed 9% to $306.9 billion (annual rate). Multifamily housing finished the year on a strong note, rising 26% after retreating 12% in November.

December featured groundbreaking for 14 multifamily projects valued each at $100 million or more, led by the $275 million Ancora Apartment Tower in Chicago IL, a $260 million condominium tower in Minneapolis MN, and a $250 million condominium tower in Sunny Isles Beach FL.

Single family housing in December increased 4%, maintaining the modest if at times hesitant upward trend that was present during 2016.

The 2016 amount for residential building was $287.0 billion, up 6% and a smaller gain than the 16% hike reported for 2015. Much of the deceleration was due to a considerably slower increase for multifamily housing, which grew just 3% as opposed to the 22% jump in 2015.

The nation’s leading multifamily market by dollar volume, New York NY, dropped 28% in 2016 after surging 53% in 2015. Multifamily construction in New York City had been supported by the 421-a program, which provided tax incentives to developers who included affordable housing in their projects. During 2015, the pending expiration of the 421-a program contributed to developers moving up the start date for projects, while the expiration of the program in January 2016 removed the incentives.

If the New York NY metropolitan area is excluded, multifamily housing for the nation in 2016 would be up 13% in dollar terms, essentially the same as the corresponding 14% increase in 2015.

After New York NY, the next metropolitan areas for multifamily housing in the top 10 by dollar volume all registered double-digit increases in 2016. Rounding out the top five markets, with their percent change from 2015, were the following – Los Angeles CA, up 50%; Miami FL, up 14%; Chicago IL, up 82%; and Washington DC, up 20%. Metropolitan areas ranked 6 through 10 were the following – Boston MA, up 45%; Dallas-Ft. Worth TX, up 22%; San Francisco CA, up 63%; Atlanta GA, up 52%; and Denver CO, up 29%.

Single family housing in 2016 grew 8% in dollar terms, a more measured pace compared to its 14% gain in 2015. By geography, single family housing in 2016 showed this pattern for the five major regions – the Midwest, up 10%; the South Atlantic, up 9%; the West, up 8%; the Northeast, up 5%; and the South Central, up 4%.

Nonbuilding construction

Nonbuilding construction in December plummeted 41% to $82.0 billion (annual rate), with especially steep declines by two project types susceptible to month-to-month volatility – electric utilities/gas plants and miscellaneous public works.

- The electric utility/gas plant category plunged 89% in December, following a 58% hike in November that reflected the start of the $2.1 billion Elba Island Liquefaction Project in Savannah GA which will enhance natural gas liquefaction and exporting capabilities at that location.

- Miscellaneous public works, which includes site work, pipelines, and mass transit, fell 47% from November which received support from the start of the $155 million Yerba Buena Island Redevelopment site work project in San Francisco CA.

- Weaker activity in December was also reported for sewer construction, down 8%; highways and bridges, down 10%; and river/harbor development, down 74%.

- Water supply construction was the one nonbuilding project type able to report a December gain, surging 53% with the push coming from the start of large water treatment facilities in North Dakota ($130 million) and California ($110 million).

For the full year 2016, nonbuilding construction dropped 11% to $161.8 billion, retreating after the 24% increase reported in 2015. Much of the nonbuilding decline was due to a 25% reduction for the electric utility/gas plant category following its sharp 127% ascent in 2015. While the dollar amount of gas plant projects fell 67% in 2016, the electric power-related portion of the category came through with a 12% gain.

Large electric power projects that reached the construction start stage during 2016 included the $1.3 billion Dominion Resources natural gas-fired power plant in Virginia, the $1.2 billion Lackawanna Energy Center natural gas-fired plant in Pennsylvania, and the $900 million Wind X wind farm in Iowa.

The public works categories as a group retreated 5% in 2016 after a 3% pickup in the previous year.

Highway and bridge construction fell 14% in 2016, essentially returning to the 2014 amount after increasing 13% in 2015.

Annual declines for 2016 were also reported for river/harbor development, down 11%; and sewer construction, down 14%; while water supply construction was able to edge up 2%.

The miscellaneous public works category registered a strong 21% gain in 2016, helped by a 162% increase for pipeline work that reflected the start of two large projects – the $3.8 billion Dakota Access Pipeline in the upper Midwest and the $3.0 billion Sabal Trail and Florida Southeast Connection natural gas pipeline upgrade in the southeastern U.S. The mass transit portion of the miscellaneous public works category held steady in 2016 with the previous year, with support coming from the start of the $1.7 billion Mid-Coast Corridor Transit Project in San Diego CA.

The 1% increase at the national level for total construction starts in 2016 was the result of a mixed performance at the five-region level. Total construction gains were reported in the West and the South Atlantic, each up 10%; and the Midwest, up 5%. Total construction declines were reported in the Northeast, down 2% (which reflected the retreat for multifamily housing in the New York NY metropolitan area); and the South Central, down 16% (which reflected that region’s comparison to 2015 which included the start of several massive liquefied natural gas export terminals).

About Dodge Data & Analytics: Dodge Data & Analytics is a technology-driven construction project data, analytics and insights provider. Dodge provides trusted market intelligence that helps construction professionals grow their business, and is redefining and recreating the business tools and processes on which the industry relies. Dodge is creating an integrated platform that unifies and simplifies the design, bid and build process, bringing data on people, projects and products into a single hub for the entire industry, from building product manufacturers to contractors and specialty trades to architects and engineers. The company’s products include Dodge Global Network, Dodge PlanRoom, Dodge PipeLine, Dodge SpecShare, Dodge BuildShare, Dodge MarketShare, and the Sweets family of products. To learn more, visit www.construction.com.